Streamlining Due Diligence Through Intelligent Document Analysis

We developed a tailored analytics solution that processes extensive deal documents to extract targeted, context-relevant investment information, transforming complex data rooms into actionable intelligence for faster due diligence workflows.

The client faced significant challenges analyzing vast amounts of heterogeneous documents within their deal data rooms. Critical investment information was scattered across financial statements, legal documents, market analyses, and operational reports, making it difficult for their teams to quickly identify key investment drivers and risks essential for timely decision-making.

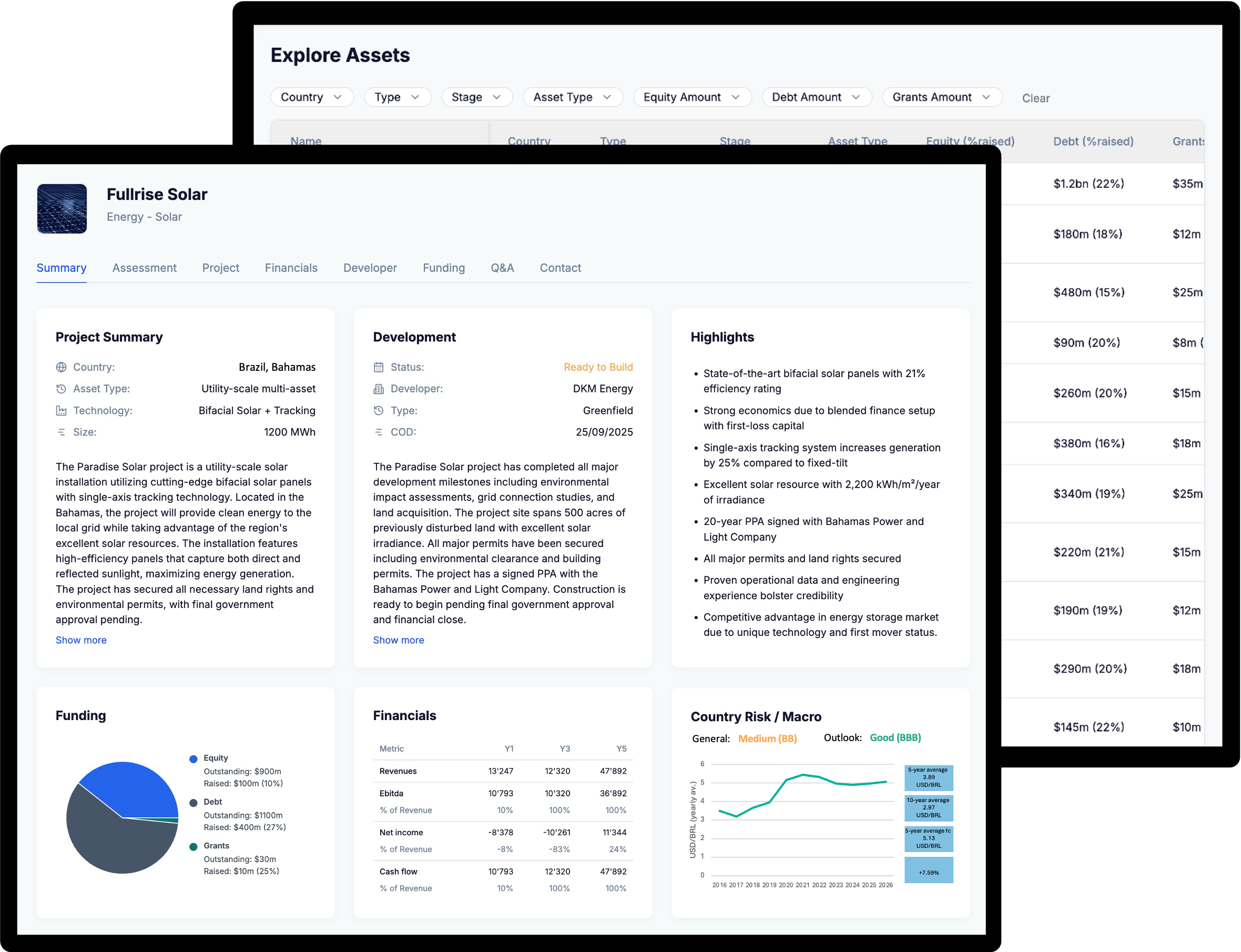

We designed and implemented a sophisticated analytics solution employing multiple AI agents and specialized algorithms to process and analyze extensive document collections. The system intelligently extracts targeted investment information most relevant to each specific deal context, automatically identifying critical financial metrics, market positioning, operational insights, and potential risk factors.

The delivered solution creates a structured intelligence layer over complex data rooms, enabling investment teams to rapidly access context-relevant insights and maintain comprehensive deal knowledge throughout their investment process. This approach transformed overwhelming document repositories into organized, actionable investment intelligence that significantly accelerated their due diligence timelines.